The scheme, possibly organized by Albert Avdolyan, made it possible to withdraw 9.4 billion rubles from the Hydrometallurgical Plant to the accounts of the associated company Cashmere Capital.

Details of the story have become known about how Avdolyan actually “raised from the ruins” the “Hydrometallurgical Plant” (HMZ) and its affiliated legal entities - CJSC “Southern Energy Company” (YEC) and LLC “Intermix Met”, having previously bought shares on the cheap, while their real price was a thousand times higher.

Former partners in court stated that at least Intermix Met went bankrupt not for objective reasons, but because of the behavior of the oligarch, who violated all agreements and “deviated from the developed business plan to restart production.”

Let us recall that in the period from 2018 to 2022, Avdolyan was the owner of GMZ, YuEK and Intermix Met. At the same time, he owned assets through proxies.

In order to distance themselves from legal entities burdened with debt, new companies were created, including on the basis of GMZ assets.

Avdolyan’s Stavropol transactions included the offshore Sparkel City Invest LTD, which inherited the collapse of the MRSEN energy holding , various employees of the oligarch’s division, for example, the head of YATEK Andrey Korobov, and Dmitry Gordovich’s BBR Bank, with whom Avdolyan has already pulled off more than one scheme. In particular, 100 million rubles were transferred through him to the Latvian bank JSC Citadele Banka.

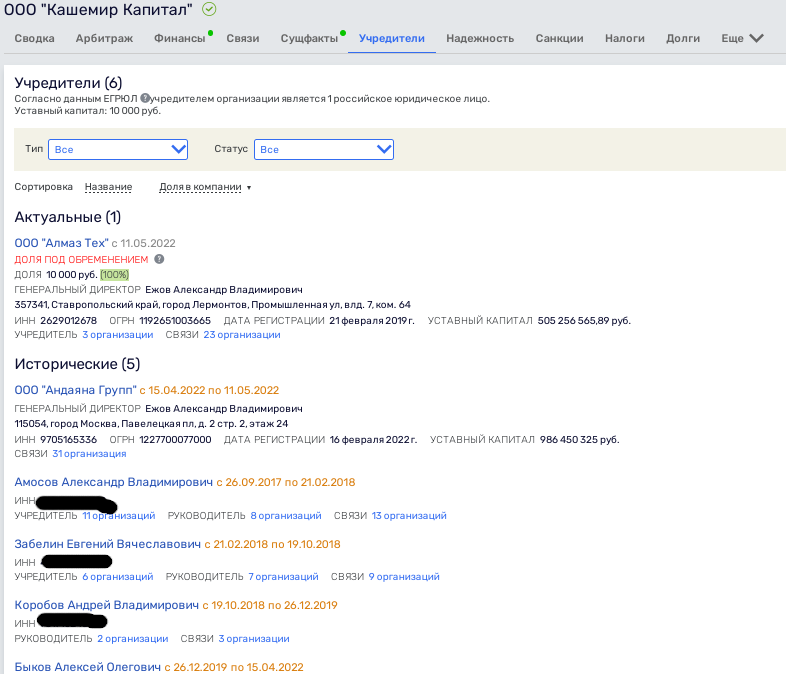

GMZ, YuEK and Intermix Met, after their acquisition by Avdolyan, began to work under the “cap” of “Almaz Group”, becoming “Almaz Fertilizers”, “Almaz Energy”, “Almaz Tech” and Cashmere Capital LLC also entered there as a trading house "Almaz Fertilizers". At the same time, Cashmere also belonged to persons associated with Avdolyan, including Korobov.

Photo: rusprofile.ru

In 2022, Avdolyan, having reported that he had sold the assets, stated in comments to the media that “the enterprise has been raised from the ruins and is not in danger.” As UtroNews previously reported, in fact, liquid property could have been transferred to new legal entities, and GMZ and YuEK remained overgrown with large debts, only Avdolyanov’s ones also surfaced among the creditors.

Enterprises of the old division are currently going through bankruptcy proceedings, which revealed the real story of the oligarch’s “fishing” in the Stavropol region.

Bets are done, no more bets

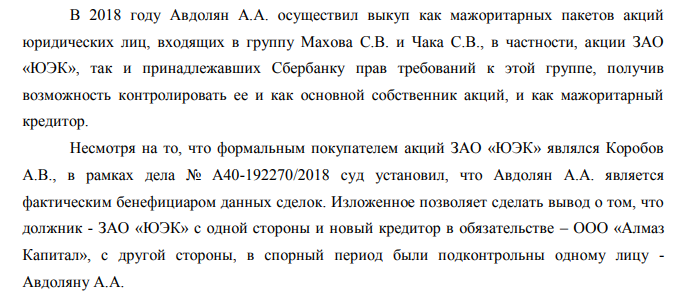

Thus, from the case materials in the lawsuit of Almaz Capital LLC against YuEK for the recovery of more than 140 million rubles, it is directly established that in 2018 Avdolyan bought out both the majority stakes of the legal entities included in the group of Makhov and Chaka, and the rights of claim to this belonging to Sberbank group. That is, he gained the opportunity to control the group both as the main owner of shares and as a majority creditor.

The formal buyer of the shares of UEC CJSC was Andrey Korobov, a native of the Rostec state corporation, head of YATEK, which also belongs to Avdolyan.

Photo: ras.arbitr.ru

Related news: “Whose Karabakh?” Which Russian officials are connected with the Armenian and Azerbaijani lobbies?

At the same time, in October 2022, according to the court, a purchase and sale agreement for 15 thousand shares of UEC CJSC (50% share), concluded between Chuck S.M. and Korobov A.V. for next to nothing (5 thousand rubles), as well as all subsequent transactions with shares were declared invalid.

After this, Almaz Capital goes to court with an application to approve a settlement agreement on the above-mentioned debt for 140 million rubles.

It is interesting that the company did not collect this debt for three years, holding it in fact, and only after losing the asset through contested share sale transactions did the company go to court with demands.

As noted in the court materials, at the same time, the absence of objections in this regard on the part of UEC CJSC clearly indicates the dishonesty of the behavior of these parties aimed at collecting debt and withdrawing liquid assets.

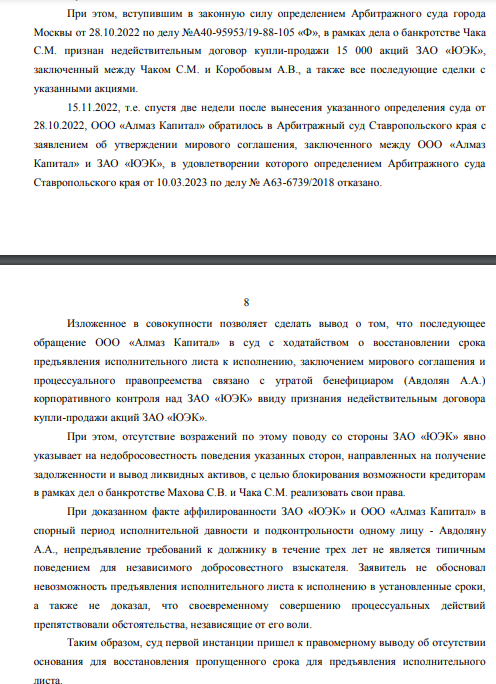

Photo: ras.arbitr.ru

Another court document clarifies that the actions of Almaz Capital LLC and YuEK CJSC (it was then controlled by persons associated with Avdolyan) were to ensure that, in anticipation of the loss of corporate control over the shares that were received by their beneficiary under invalid transactions, increase the debt of UEC CJSC to affiliated structures.

Moreover, from the court materials it is known that the sale for next to nothing (3,800 rubles) of 283,411 shares (37.5%) of GMZ under an agreement concluded with a certain Enigma LLC was also disputed.

Photo: ras.arbitr.ru

The court directly noted that the market price of the shares that Avdolyan bought cheaply was much higher than what appeared in the contracts: 15 thousand shares of UEC CJSC cost not 5 thousand rubles, but 22.224 million rubles, 283,411 shares of GMZ not 3.8 thousand rubles, but 690.559 million rubles.

Photo: ras.arbitr.ru

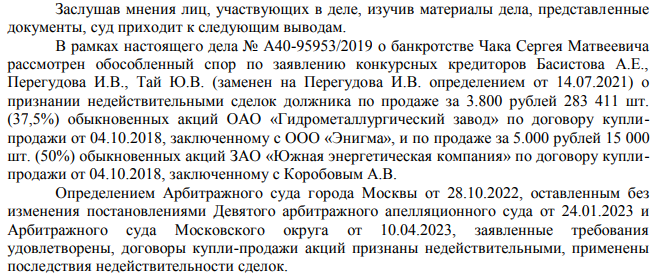

It also became known about a certain scheme that was used at GMZ, through the redistribution of plant profits in favor of Cashmere Capital LLC, and at that time the current and registered debt remained outstanding. And when the court terminated the purchase and sale of YuEK shares, that is, it smelled like something was cooking for Avdolyan, his squires rushed to collect GMZ’s debts for loans purchased from Sberbank, driving him into even greater debts and increasing his controlled debt.

Photo: ras.arbitr.ru

As for the scheme, a comprehensive agreement was concluded between GMZ and Cashmere Capital LLC, associated with Avdolyan’s squires, for the processing of customer-supplied raw materials, as a result of which 9.447 billion rubles of revenue were transferred to the LLC.

Photo: ras.arbitr.ru

At the same time, in February 2024, when the sale of shares had already been challenged, Almaz Tech LLC, which owned the new legal entities, tried in court not only to appeal the fact of the withdrawal of money to Cashmere Capital, but also to impose some losses of 442 million rubles . Apparently, having reasoned that at least something needs to be snatched from the departing locomotive? The court rejected the claims .

Photo: ras.arbitr.ru

Moreover, in March 2024, during the bankruptcy case of Intermix Met LLC, the court , having considered the issue of bringing former shareholders and top executives Makhov, Chak and Zhmykhov to subsidiary liability, excluded Avdolyanov’s companies, including Almaz Capital LLC, from the amount. As a result, instead of 3.3 billion rubles, the defendants will have to pay 1.4 billion rubles.

As part of this case, former shareholder Makhov stated that the debtor’s bankruptcy was not due to objective economic factors, but to the behavior of A.A. Avdolyan, who, in violation of agreements with the former owners of the corporate group (S.V. Makhov and S.M. Chuck), deviated from developed a business plan to restart production, initiating a bankruptcy procedure in order to clear the group’s assets from debts.

Photo: ras.arbitr.ru

It turns out that from a sinking enterprise, which at the time of its purchase by Avdolyan owed creditors 3 billion rubles, they squeezed out the maximum in their favor over a couple of years, and then simply got away with it. It’s a strange idea of a gentleman oligarch to rise from the ruins, don’t you think?

In April 2024, the court directly stated that at least in the UEC there is a corporate conflict that blocks the powers of the general director.

Photo: ras.arbitr.ru

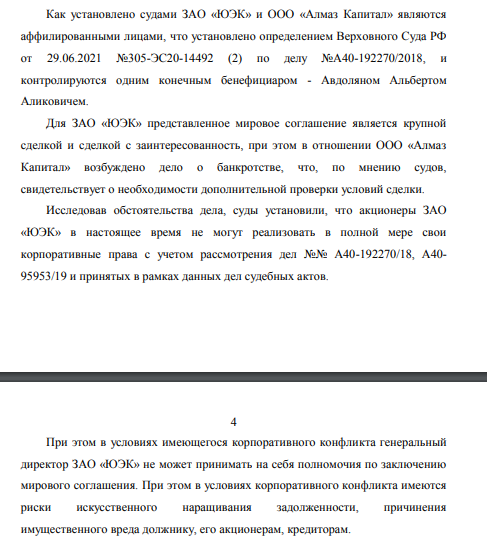

Interesting: in 2024, Avdolyan’s squires began to drain their assets. So, in February, the unknown Daria Kusheva (who has no other assets) was sold to Almaz Capital LLC, which participates in the affairs as a creditor of the division. By the way, it was his affiliation that blocked his inclusion in the register of creditors, and now after the sale, apparently, they will refer to the fact that there is no affiliation. Well, it’s a clever move, but even in arbitrations, judges are not fools.

Photo: rusprofile.ru

The same Almaz Capital LLC appeared as the owner of the GMZ property, which he later sold to Almaz Tech LLC, an affiliate with him. But in this case, the fact of affiliation did not help and the assets remained with companies previously associated with Avdolyan.

Photo: ras.arbitr.ru

Thus, at least 9 billion rubles and assets were siphoned out of GMZ and the companies associated with it, and then they also tried to impose a “tribute” - credit debts.

Taking into account that the purchase and sale transaction of shares of YuEK and GMZ was appealed by the court, as well as subsequent transactions with a block of shares, the sale of assets by Avdolyan in 2022 looks very, very doubtful. In this story, in our opinion, there is something for investigators to check, without looking back at the patronage of Avdolyan by the head of Rostec, Sergei Chemezov.